Marine Insurance

MARINE INSURANCE

Definition: Marine insurance is a contract in which the insurer undertakes to indemnify the insured against the future marine losses incidental to the marine adventure as per the agreed terms of contract.

What is Contract?

Offer = acceptance = Promise

Promise + consideration = Agreement

Agreement + Legal enforce-ability = contract

MARINE ADVENTURE (Voyage):

It is an adventure in which:

- Any property that is insured (Ship, Goods or Cargo) is exposed to maritime perils (Risks).

- Any earnings or acquisitions of freight, commissions, profits, financial benefits, any security on advances, loans, disbursements etc. are endangered by exposure of the insured property to maritime perils. Ex: Bottomry Bond, Respondentia Bond.

- Any liability to third party, which may be incurred by the owner, or any person responsible for the insured property is exposed to maritime perils.

MARITIME PERILS

Maritime Perils means the perils or dangers incidental to the navigation of the ship at sea. This Includes

- Perils of the sea (Act of winds, waves and other forces of nature)

- Fire

- Act of war

- Act of public enemies

- Act of God/Vis Major/Force Majeure/ Force Major

- Piracy

- Robbery, theft or pilferage

- Capture by alien enemy

- Restraint of princes, detainment by rulers and government of people

- Jettison

- Any other perils similar to one at the land.

LOSSES COVERED BY PERILS OF SEA are:

- Loss of cargo caused by vessel striking upon a submerged rock or wreck

- Loss due to fouling or collision

- Loss brought about by ship’s crew by negligence so long is not willful

- Loss or damage to grains due to ingress of moisture when the ship sails through rough weather.

- Loss or damage to grains by heating of compartments when the ship sails through rough weather and the ventilations of the compartments are closed.

- Damage of cargo caused by entrance of seawater through rat holes.

LOSSES NOT COVERED BY PERILS OF SEA are :

- Loss or damage of cargo due to chemical reaction with seawater.

- Action of worms on Timbers/Woods etc.

- Death of cattle carried as cargo due to shortage of fodder on elongation of ship’s voyage.

TYPES OF MARINE INSURANCE POLICY:

- Voyage Policy

- Time Policy

- Mixed Policy (Voyage & Time)

- Construction or Builders Policy

- Dock or Port Policy

- Valued Policy

- Unvalued Policy

- Open Cover Policy

- Floating Policy

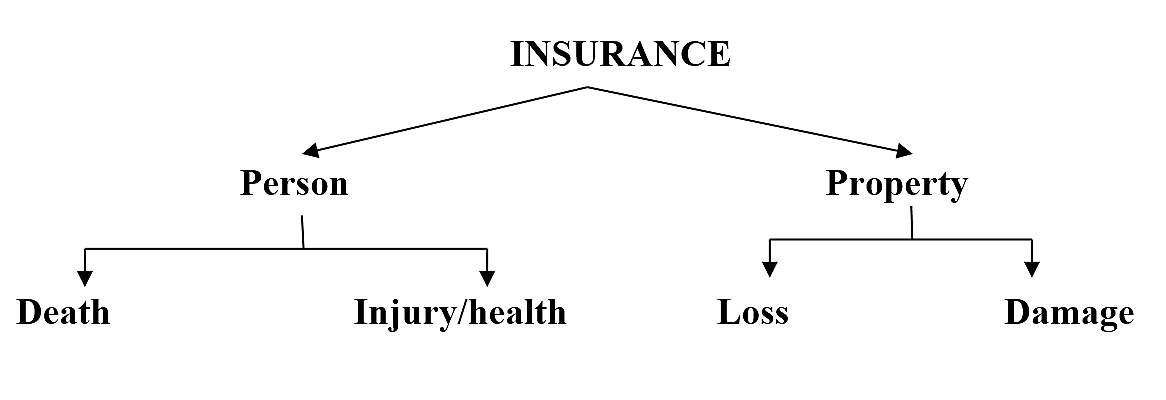

Diagram is very illustrative.